number of visits: 0

Add to favorites

Add to favorites

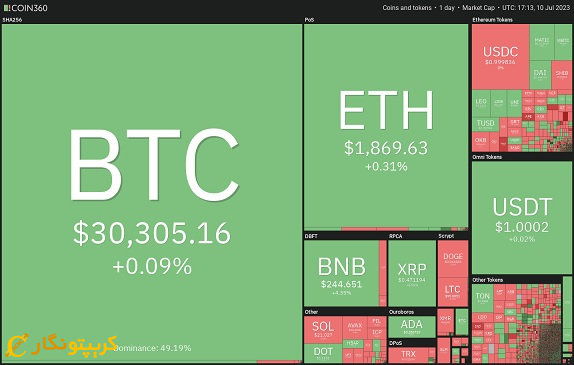

The weakness of the US dollar index bodes well for Bitcoin and altcoins in the short term.

Bitcoin is trying to increase and maintain above the $31,000 level. But Standard Chartered has shown a bullish picture for this year and the future.

Big investors are taking a bullish stance and taking full advantage of stagnant Bitcoin prices. Sharks and whales (institutions with between 10,000 and 10,000 bitcoins) have increased their holdings by 71,000 bitcoins since mid-June.

The US stock market will likely be influenced by second quarter earnings and inflation data due out on July 12.

Bitcoin price

Bitcoin bounced back from the 20-day moving average ($29,886) on July 7. But he tried again on July 10. Trying again in the short term can weaken it.

The bulls need to push the price above the $31,000-$31,500 resistance zone to avoid a fall. This area will attract high sales; But if the bulls overcome this barrier, the BTC/USDT pair will climb towards $40,000.

On the other hand, if the price falls below the 20-day moving average, it will show a deep correction. This correction could keep Bitcoin between $24,800 and $31,500 for longer.

Ether price

Bulls protect the 50-day simple moving average (SMA). On the other hand, they are trying to push Ether above the 20-day EMA ($1871).

Both the EMA and the Relative Strength Index (RSI) are close to the midpoint, which indicates a balance between supply and demand. If buyers push the price above the 20-day moving average, the ETH/USDT pair will reach the resistance above $2,000.

But when the price falls below the 50-day SMA, the price drops to $1,700. If the ETH/USDT pair surrenders, it will slip again and move towards $1626.

US dollar price

The pressure of the bears has caused the US dollar index (DXY) to return below its moving average.

At the next stage, this indicator may fall to the support level of $101.92. As expected, buyers strongly defend this level. Because a break of this would challenge the support level at 100.82. This is an important level to be very careful about. When this level is broken, the next stage of the downward trend begins.

On the contrary, once the price crosses $101.92, the bulls will try to cross the barrier of $103.57. This nullifies the downtrend. It also indicates the return of cattle.

Dogecoin price

Buyers are barely pushing DOJ above its 20-day moving average ($0.07); which indicates the defense of the bears from this level.

Bears are trying to push the price below the $0.06 support level. This level attracts buyers.

The next move starts after the price rises above $0.07 or falls below $0.06. Until then, the price will continue to be random and unstable.

Source: cointelegraph.com